Managing finances is one of the biggest challenges for small business owners, freelancers, and entrepreneurs. FreshBooks is a cloud-based invoicing and accounting software designed to make financial management simple, efficient, and stress-free. With an intuitive interface and powerful automation features, FreshBooks helps businesses streamline invoicing, expense tracking, payments, and reporting—all in one place.

- Effortless Invoicing for Faster Payments

Creating and sending invoices has never been easier. FreshBooks offers professional invoice templates that can be customized with your logo, branding, and payment terms. Businesses can set up recurring invoices, automate payment reminders, and even accept online payments through credit cards, PayPal, and other methods. The platform tracks invoice statuses in real time, helping you stay on top of payments and reduce unpaid balances.

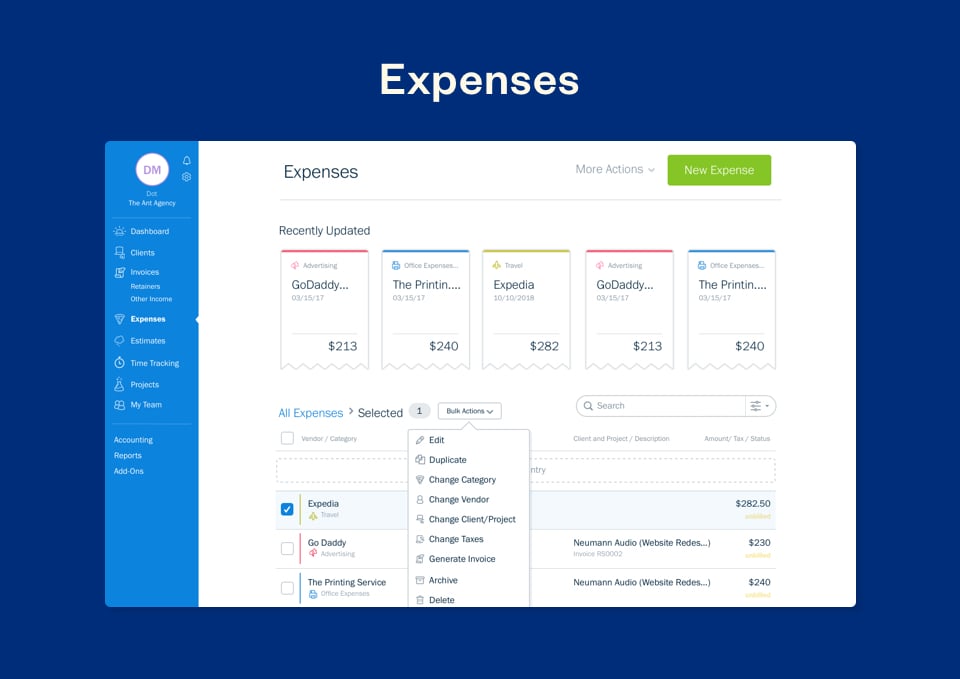

- Seamless Expense Tracking and Financial Organization

Tracking business expenses manually can be tedious and error-prone. FreshBooks simplifies expense management by allowing users to snap and upload receipts, categorize expenses, and automatically import transactions from linked bank accounts. Small businesses can monitor spending patterns, generate expense reports, and ensure accurate tax calculations, saving time and reducing financial headaches.

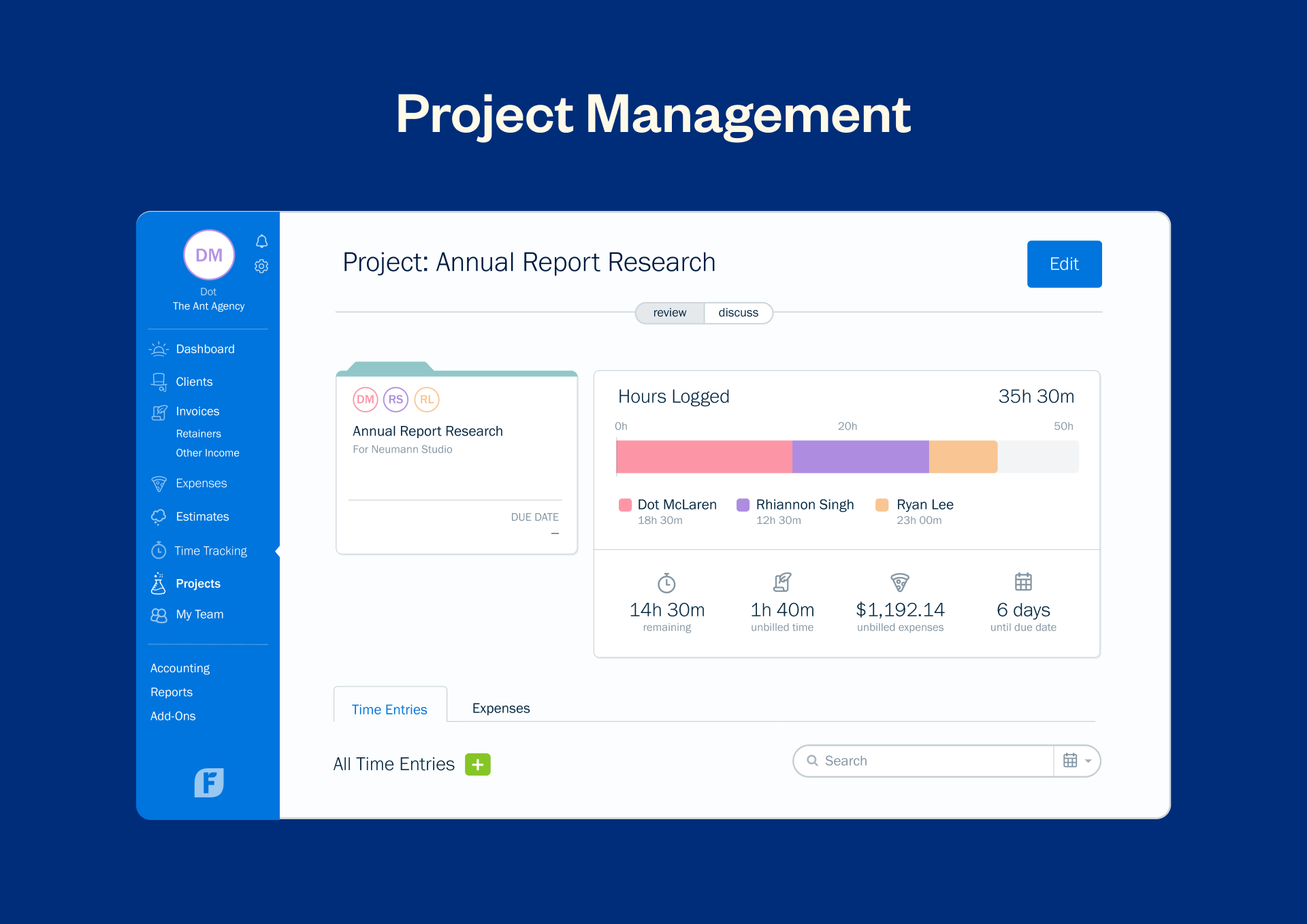

- Automated Time Tracking for Accurate Billing

For service-based businesses, billing clients based on time worked is crucial. FreshBooks includes a built-in time tracker that lets users log hours directly from the dashboard or mobile app. The system seamlessly converts tracked hours into invoices, ensuring that clients are billed accurately for every minute of work.

- Comprehensive Accounting Without Complexity

FreshBooks isn’t just for invoicing—it’s a full-fledged accounting solution tailored for small businesses. It includes double-entry accounting, enabling businesses to manage profit and loss statements, balance sheets, and tax reports with ease. Automated bank reconciliation ensures that transactions match bank records, reducing errors and improving financial accuracy.

- Easy Payment Processing and Cash Flow Management

Getting paid on time is crucial for small business success. FreshBooks integrates with multiple payment gateways, allowing businesses to accept payments online via credit cards, ACH transfers, and third-party platforms like Stripe and PayPal. With automatic late payment reminders and late fees, business owners can improve cash flow while maintaining professional client relationships.

- Powerful Reporting and Insights

FreshBooks provides detailed financial reports, including profit and loss statements, tax summaries, and expense breakdowns. These reports help small business owners make data-driven decisions, track financial health, and prepare for tax season effortlessly.

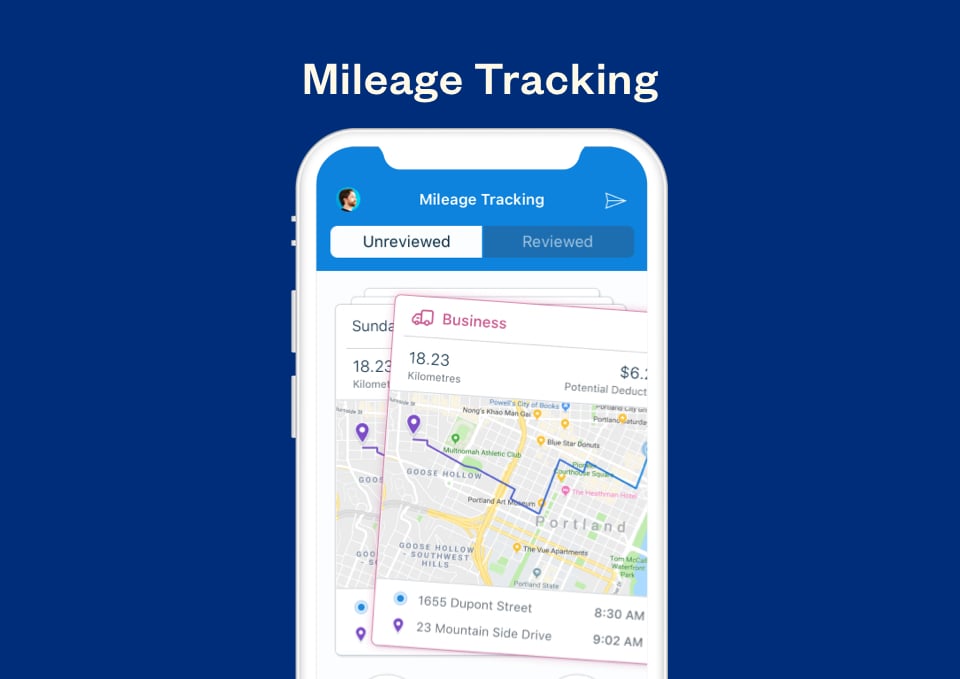

- Mobile-Friendly for Business on the Go

FreshBooks offers a robust mobile app for iOS and Android, ensuring that business owners can manage invoices, track expenses, and monitor payments from anywhere. Whether you’re working from the office, a coffee shop, or traveling, your financial data is always at your fingertips.

Why Choose FreshBooks?

- User-Friendly Interface – No accounting experience required.

- Cloud-Based Accessibility – Access financial data from anywhere.

- Automation – Save time with recurring invoices, expense tracking, and reminders.

- Integration – Connects with apps like Shopify, G Suite, and Trello.

- Secure & Reliable – Ensures data security and compliance with financial regulations.

FreshBooks is more than just an invoicing tool—it’s a complete financial management system built for small businesses, freelancers, and entrepreneurs. With powerful automation, easy-to-use features, and seamless integrations, FreshBooks helps businesses save time, stay organized, and get paid faster.

If you’re looking for a hassle-free way to manage invoices, expenses, and accounting, FreshBooks is the perfect solution to keep your business finances in check.

FreshBooks

FreshBooks

2004

2004

Canada

Canada

501-1000

501-1000

Invoice Processing

Invoice Processing